Financial transactions cover a variety of services involving any type of financial instrument.

Common arrangements include intercompany loans, financial guarantees, cash pooling arrangements and captive insurance structures.

The transfer pricing analysis of an intercompany loan can involve multiple steps. These include:

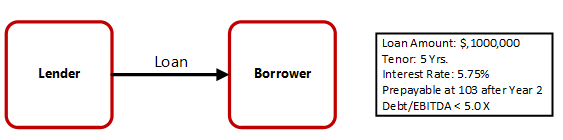

(a) Projecting the cash flow of the borrower (if no budgeted projections are available), (b) Comparing the leverage/coverage ratios of the borrower with financial covenants between independent borrowers and lenders (c) Developing a credit rating of the borrower and (d) Finding comparable loans and bonds to the intercompany loan and making adjustments for any structural differences to develop an arm's length range of interest rates.

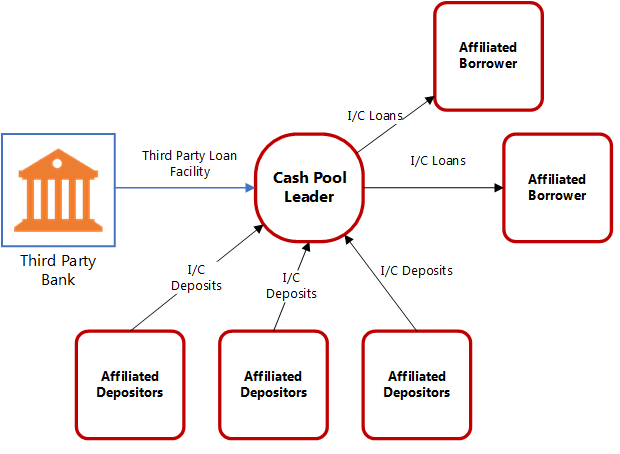

Cash Pooling Arrangements: These are formalized systems of intercompany borrowings and lending co-ordinated through a Cash Pool Leader that takes deposits from cash-rich subsidiaries, and lends it out to others on a short-term basis for their working capital needs. When surplus deposits across the MNE are insufficient to meet these capital needs, the Cash Pool Leader may also avail third-party lending facilities to fund the shortfall.

Cash Pooling Arrangements can range from the Cash Pool Leader acting merely as an administrative agent providing a centralized function to the cash pool participants based on pre-established borrowing/lending terms or it can act as a fully independent group treasury, making independent capital raising and lending decisions.

The transfer pricing policy will be a spread between the rate the Cash Pool Leader pays on deposits and the rate it charges on lent funds. When the Cash Pool Leader is acting merely as an administrator, the spread will target a recovery of the relevant operating costs plus an adequate level of profit. Alternatively, when it assumes a comprehensive treasury function, the spread will also reward the Cash pool Leader for its capital exposure.

As a best practice, the cash pooling arrangement should be formalized through intercompany agreements to clarify the scope of the responsibilities of the Cash Pool Leader and participating entities. .

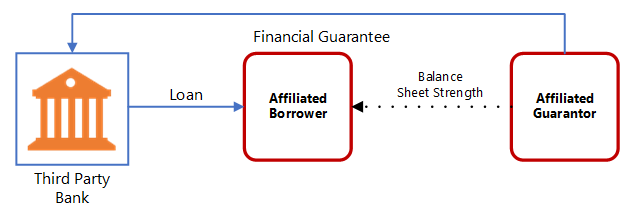

Financial Guarantees: These transactions involve a guarantor providing an explicit guarantee on behalf of an associated borrower to an independent lender. This is typically done to reduce external borrowing costs by leveraging the balance sheet strength of a stronger parent group. While any operating subsidiary will inadvertently benefit from its association with the larger group/ parent (commonly referred to as implicit support) - and for which no arm's length payment is necessitated - the provision of an explicit guarantee does, on the other hand, does result in an arm's length compensation to the guarantor (by the borrower).

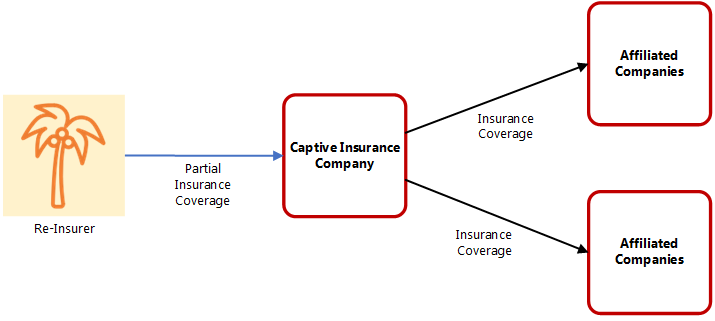

Captive Insurance Arrangements: These structures involve a dedicated Captive Insurance Entity providing insurance coverage to a pool of associated companies. Typically the captive insurance company will obtain re-insurance from an arm's length provider to reduce its overall exposure.

The Insurance premiums charged by a Captive Insurance Entity to its affiliates would attempt to capture the cost of reinsurance premiums, general administrative costs plus an adequate return for capital at risk

Intercompany Loans: Multi National Enterprises (MNEs) provide capital funding to members within the group through equity and/or loan advances. When companies issue loans to affiliated borrowers, it triggers transfer pricing considerations with respect to (a) the amount of the loan advance and (b) the rate of interest on the facility. An arm's length rate of interest will depend, among other factors, on the structural provisions of the loans (seniority, collateral, tenor, prepayment provisions), the credit worthiness of the borrower, and fixed or floating rate structure.

Financial Transactions

Financial Transactions

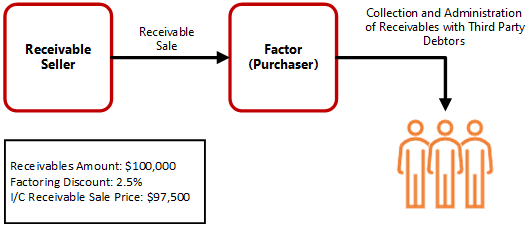

Factoring Arrangements: These arrangements relate to the transfer of trade receivables between affiliates. Determining the appropriate transfer price of receivables (based on a discount to face value) involves the following:

Determining whether the sale of receivables constitutes a "true" sale between the affiliated seller and buyer. A true sale is deemed to have occurred when the receivables are transferred to the acquirer on a non-recourse basis i.e. the default risk of the underlying receivables is also transferred onto the acquirer.

Determining the appropriate rate of discount. The discount rate is based on a number of additive factors, including the underlying currencies (which informs the base rate), weighted time to maturity, anticipated dilutions (pre-payments) and default risk (based on the credit risk of the debtors) and an administrative spread to reward the factor (purchaser) for the collection and administration of the receivables. In some arrangements, the administrative functions are retained by the seller, reducing the discount rate.

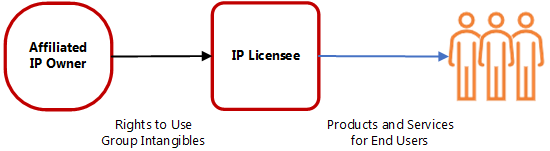

This typically involves the licensing of patents, franchise rights, software licenses by an affiliated licensee to manufacture products or provide services to third-parties.

The licensed Intellectual Property can represent a fully developed product (patent/fully developed software platform) or an input (such as a source code or data) for an entirely novel product or class of products developed and owned by the licensee.

An arm's length charge is typically structured as a royalty fee based on percentage of product/service revenues using comparable licensing agreements for similar intangibles. Almost by definition, intangibles are highly unique and any arm's length royalty rate will need to also consider the general profitability of the underlying product/service and the contribution of the intangible toward creating value for the licensee (cost savings or a competitive market advantage). This can create some element of subjectivity.

Licensing of Intellectual Property

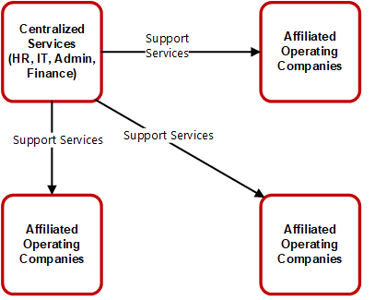

Centralized Support Services

It is quite common for large MNEs to centralize administrative functions such as HR, IT, Finance, Accounting. This is typically undertaken to realize scale efficiencies, improve utilization levels, and to benefit from the lower cost environment of some regional offices.

An arm's length charge for centralized support activity is typically based on the costs of providing the support plus a profit margin. The profit margin will vary based on the nature of the service provided.

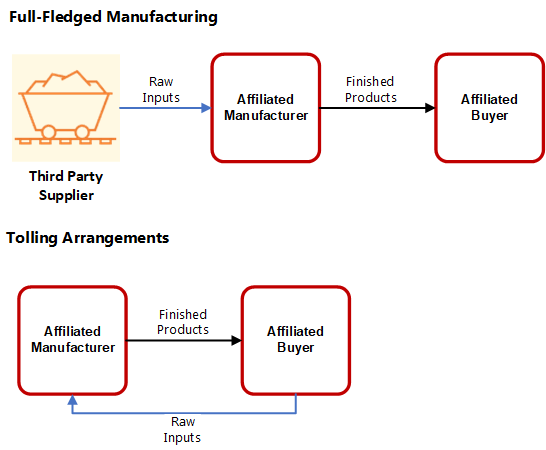

Manufacturing

Broadly, manufacturing arrangements can range from a manufacturer acting as a full-fledged manufacturer or a toll manufacturer.

A full manufacturer will independently procure raw materials from third party suppliers and assume market and inventory risk while a toll manufacturer will not assume significant market or inventory risk - the raw materials are supplied to it by the affiliated buyer.

In some cases the manufacturer may also need to license IP from other affiliates to undertake proprietary production processes.

The arm's length charge to the manufacturer may be based on prevailing market prices of similar products or based on associated manufacturing costs plus a profit margin.

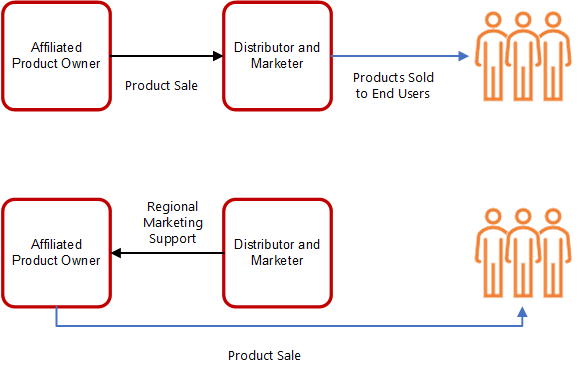

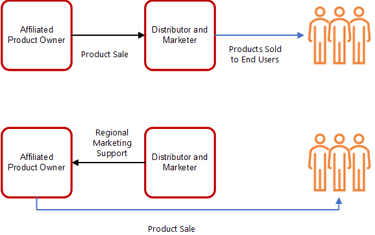

Distribution and Marketing

This generally relates to the distribution of tangible goods but also sometimes a combination of products and services promoted by a regional or national distributor.

Arrangements between associated manufacturers and distributors can range from the distributor (a) taking title to the products and then independently selling them in its assigned market or (b) acting as a sales agent on behalf of the manufacturer which then sells the product directly to the customers.

The typical arm's length reward to the distributor will target a certain resale margin in the first situation and a recovery of costs plus a profit margin in the second. The appropriate policy is generally case specific and will depend on the relevant facts and market comparability factors.

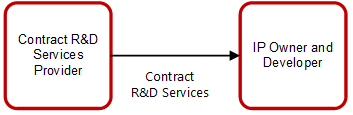

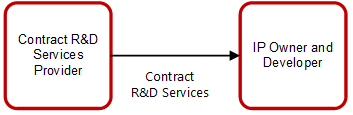

Research and Development (R&D) services typically involve multinationals in the health care sector that outsource R&D and testing (clinical trials) for pre-patent or patented drugs/medical services to an associated R&D hub that may have better access to a highly-skilled workforce or is situated in the jurisdiction of a research university.

R&D service arrangements can get controversial when the ownership of Intellectual Property manifesting from the R&D activities is not properly understood or documented. Intercompany agreements can be critical here to specifically articulate the risks of the R&D service provider as being limited to operational risks and not the risk of the success/failure of the R&D in creating a patentable invention. The agreement will also explicitly assign the legal ownership to the service recipient (IP owner).

Notwithstanding, legal ownership, the economic ownership of any intellectual property can still be challenged when the legal owner of the Intellectual Property does not also retain sufficient control over the development, enhancement, maintenance, protection and exploitation (DEMPE) of the underlying IP. This risk can be mitigated through a transfer pricing document that clearly outlines and assigns the DEMPE activities between the service provider and the recipient.

Research and Development Services

Business Restructuring

Business Restructuring is a broad term to refer to transactions involving any significant change to the functional or risk profile of the affiliated companies within the global supply chain. Typically such transactions accompany the sale of commercial or trade intangibles followed by a reassessment of the transfer pricing policies of the impacted entities.

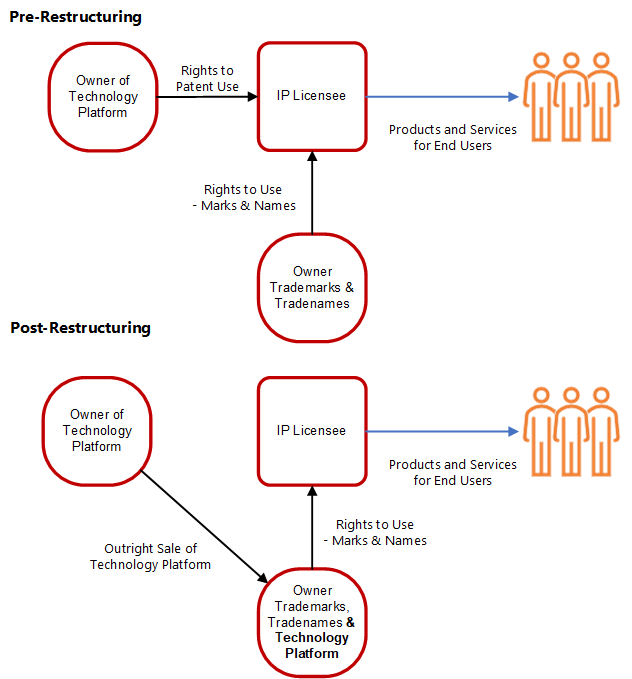

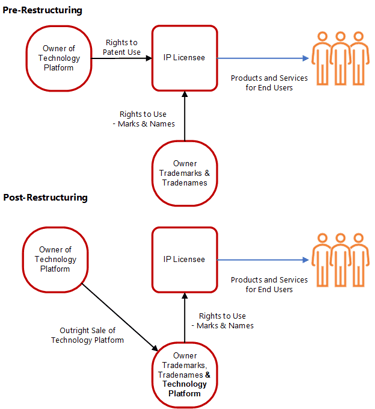

The illustration shows a typical scenario. in which multiple entities supply the rights to various intangibles to an affiliated licensee for internal use. These situations can arise when intellectual property is acquired by the MNE group through a series of acquisitions, resulting in the scattered ownership of intangibles across different tax jurisdictions. When a product developer uses intangibles owned by multiple owners to build a new product or platform, it may not always be possible to determine an arm's length royalty owing to the difficulty in finding comparable third-party licensing agreements for very specific components within a bigger bundle of intellectual property rights. .

To avoid potential challenges, an MNE group may decide to consolidate all existing intellectual property into a single IP owner which can then license out the combined portfolio of relevant intangibles to an affiliate (the IP Licensee) which is an easier transaction to price due to the availability of comparable third-party licensing agreements.

Cost Sharing Arrangements

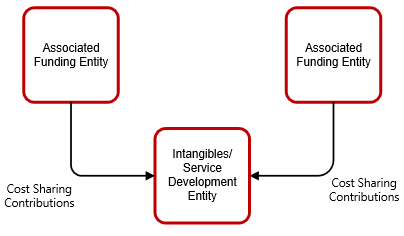

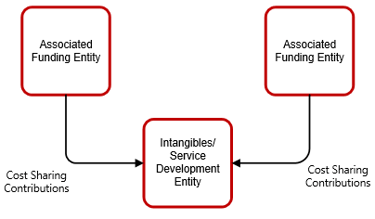

Cost Sharing Arrangement (CSA) are formalized joint ventures between two or more affiliated companies to collaboratively develop a group capability that would create a benefit for all involved participants. An example of a cost sharing arrangement would be the development of a new software product built on top of a legacy product contributed by one of the CSA participants. The ongoing development costs would be shared between the participants in proportion to the anticipated benefit (for example distribution rights in certain markets) adjusted for the arm's length value of the contributed legacy assets.

2024 BakerBanbury Corporation - All Rights Reserved